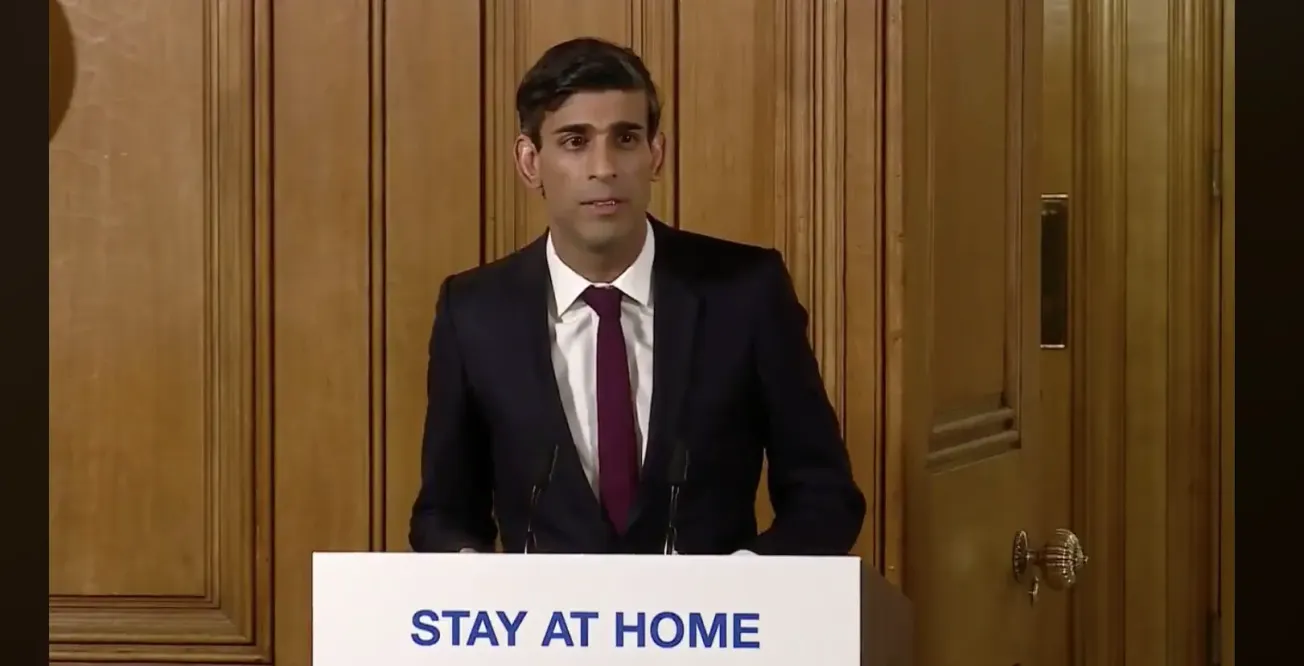

Chancellor Rishi Sunak has unveiled a further series of “unprecedented” measures to try and protect businesses and individuals impacted by the coronavirus crisis.

He said that getting through the pandemic will require a “collective national effort, with a role for everyone to play”.

The economic measures announced are:

- For the first time in British history, the government will help pay people’s wages, with grants covering 80% of the salary of those are not working due to coronavirus shutdowns, but who haven’t been sacked, up to a total of £2,500 a month. The scheme, open to any employer in the country, will cover the cost of wages backdated to March 1st and will be open before the end of April for at least three months.

- The previously announced Coronavirus Business Interruption Loan Scheme will now be interest-free for 12, not six months. Those loans will now be available on Monday.

- No business will pay VAT from now to mid June, and will have until the end of the financial year to repay those bills. That’s an over £30bn injection to businesses equivalent to 1.5% of GDP.

- The Universal Credit standard allowance has been increased, for the next 12 months, by £1,000 a year. The Working Tax Credit basic element will go up by the same amount.

- Self-employed people can now access, in full, Universal Credit at a rate equivalent to Statutory Sick Pay for employees. The next self-assessment payments will also be deferred until Jan 2021.

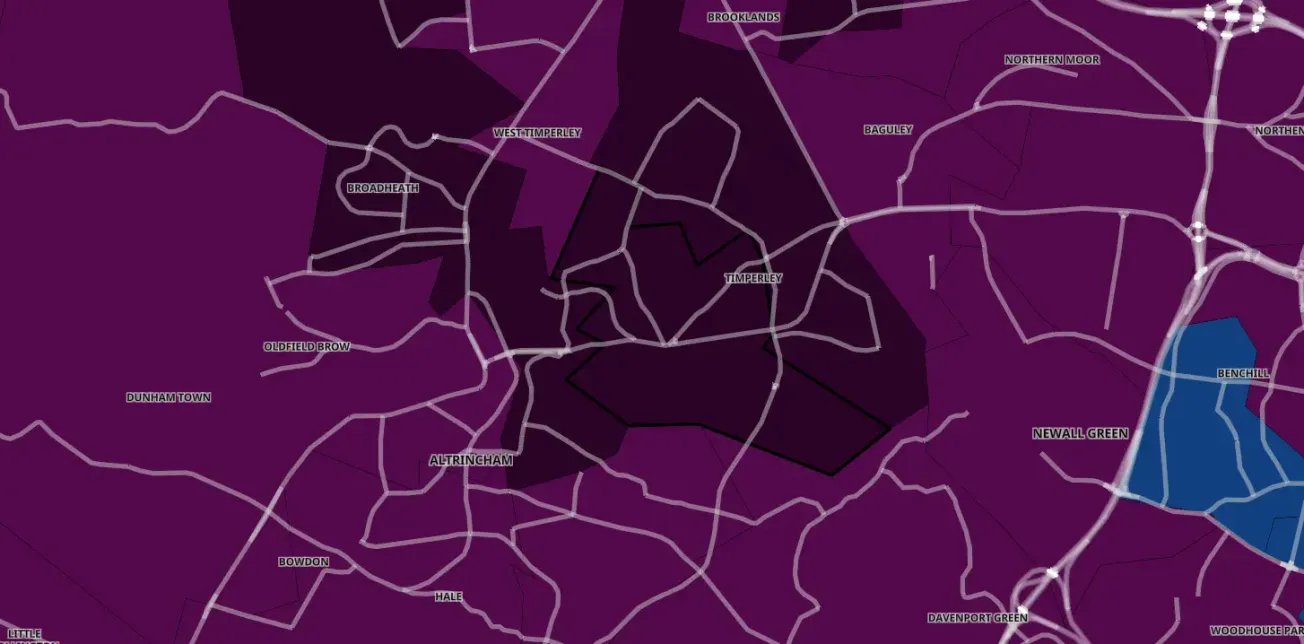

- For renters, the Chancellor increased the generosity of housing benefit and Universal Credit so that the Local Housing Allowance will cover at least 30% of market rents in your area.

Sunak said the economic intervention was “unprecedented” in the history of the British state, and will be one of the most comprehensive in the world.