We’ve partnered with Altrincham law firm Hill & Company to bring you a regular Q&A feature with one of their trusted legal advisors.

You can find the other Q&As in the series here.

This week, Dan Knox looks at whether or not you should get a prenuptial agreement before tying the knot.

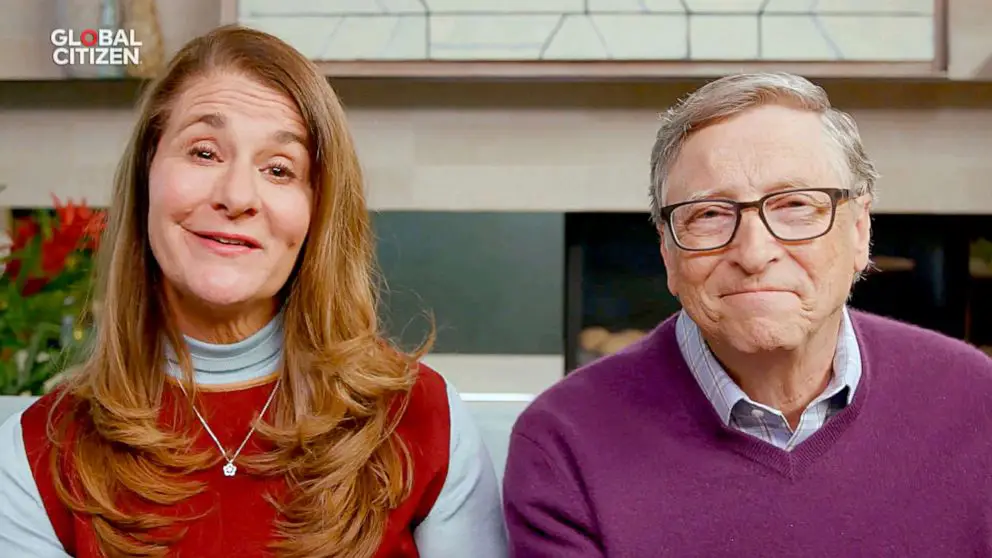

Earlier this month, Bill and Melinda Gates unexpectedly announced to the world that they are to divorce. Some of the coverage after the news broke concerned their not having a prenuptial agreement, or ‘prenup’. So what is a prenup, and do you need to be a millionaire to get one?

The use of a prenup, particularly for ultra-high-net-worth couples, has soared in popularity but more and more people are having prenups drafted as they realise that they are in fact a cost-effective form of financial planning.

A prenuptial agreement is a contract entered into by a couple prior to marriage that enables them to control what happens to their assets should the marriage end.

These documents are not just for celebrities and the super wealthy. In reality they should be viewed as simply sound financial planning. They really should be considered where one or both partners have their own assets that they might want to protect.

ALTRINCHAM TODAY: So what does your average client look like who asks for one?

DAN KNOX: We live in an age where people often come to a marriage later in life, with their own properties or children from previous relationships. So the clients who ask for a prenup tend to have had the opportunity to purchase capital assets such as a home, or have already been married previously and experienced a relationship breakdown, or have their own business interests which they would like to protect.

AT: So clients try to ring-fence family businesses?

DN: Yes. A strong pre or postnuptial agreement is the most effective way to protect your family business in the event of a divorce.

AT: What else can a prenup include?

DN: A prenup is very much tailored to your personal situation and can include a whole variety of things, many of which couples usually think about when deciding what should happen after their relationship has ended.

AT: Not very romantic though is it?

DN: No! But to be fair clients know what they want and all the trusted legal advisors here at Hill and Company do is to ensure that the tricky bits are ironed out before the wedding. Obviously the big day (or 30-people day currently) is most people’s focus and rightly so!

Clients are already aware that it can be a lot harder (and more expensive!) to have to unpick things afterwards if a relationship has broken down.

AT: Are they legally binding?

DN: Although prenuptial agreements are not legally binding in England and Wales (in Scotland, properly prepared prenups are enforceable and legally binding), they will demonstrate to the court the intention of the parties if the marriage breaks down.

A prenup is more likely to be considered ‘fair’ if:

- Both parties received independent legal advice about the agreement at the outset

- Full and frank financial disclosure of both parties’ assets was made before the agreement

- Neither party was under pressure or duress to sign the agreement against their will

- There has been no significant change that would make the agreement inappropriate (for example, the birth of children)

- The agreement is fair and realistic. If the division of assets is weighted too heavily in favour of one party, it may be judged to be unfair by the courts

- Prenups should be reviewed periodically and amended during the marriage, particularly when any child or children are born

AT: Finally, why have a prenup?

DN: Here at Hill and Company we genuinely consider a prenup simply be an extension of sensible financial planning. Rather than spend a fortune arguing about the division of matrimonial assets on divorce, it is often much better to identify and record parties’ intentions if a relationship breaks down, and unfortunately relationships do fail.

I should caveat this by pointing out that entering into a prenup does not mean that you are more likely to get divorced! But it is without doubt a useful way to outline what would happen if the worst case scenario were to happen and your marriage were to come to an end.

Dan Knox, a family solicitor and trusted legal advisor who has recently joined Hill & Company, is available to assist clients new and old in all aspects of family law. If you are facing any family law issues and would like to ask him a question, please contact him on 0161 928 3201 or email d.knox@hillandcompany.co.uk